The Unrelenting Bias Against GameStop

GameStop shocked the financial world last week, leaving analysts, Twitter pundits, and CNBC-talking-heads in disbelief. The company filed documents with the Securities and Exchange Commission that reveal an impressive net income of $48.2 million for their fourth quarter, marking a significant turnaround in their financial performance.

This surprising news came during widespread skepticism about the company’s future, fueled by continuous negative media coverage. Despite the naysayers, GameStop proved its critics wrong by not only avoiding a loss but generating a considerable profit.

The few analysts who still cover GME had predicted a significant loss for the quarter, with estimates hovering around a loss of $39.6 million. The stock reacted almost immediately to the unexpected profit, surging by approximately 50% in after-hours trading.

CORRECTION: Gamestop $GME had more income in their most recent quarter than Amazon $AMZN had in all of 2022. pic.twitter.com/Rsva8nuzdZ

— Kevin Malone (@Malone_Wealth) March 22, 2023

Hold on a second; did GameStop just have a profitable quarter? Weren’t they supposed to go bankrupt and disappear like Blockbuster? Aren’t retail investors going to lose all their money gambling on a dying video game retailer?

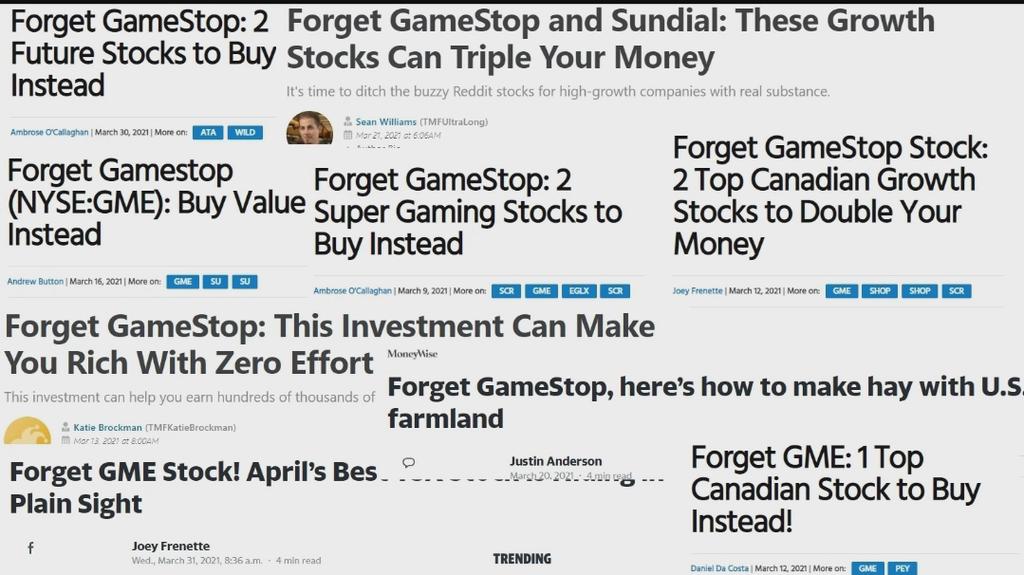

Forget GameStop

Ever since GameStop muscled into the zeitgeist in January 2021, traditional media has produced a never-ending stream of articles, audio-clips and hot takes to remind us that “retail investors” are playing with fire. They told you GameStop is a “failing brick-and-mortar” business that will eventually go bankrupt.

You should probably just “Forget GameStop”:

GameStop’s Fundamentals

Setting aside the blatant mud-slinging and fear-mongering from the financial news outlets, the bearish argument against GameStop has primarily focused on the company’s fundamentals. Prior to the involvement of Ryan Cohen, Matt Furlong, and their team, GameStop was indeed struggling to stay afloat in the rapidly changing retail landscape.

However, with the arrival of this dynamic new leadership, GameStop is transforming its business model to adapt to the evolving gaming market—challenging the bear case that had once seemed so certain.

So how are they doing now?

GameStop Q422 Results:

— Larry Cheng (@larryvc) March 22, 2023

Net Sales: $2.2B

Cash Flow from Ops: $337M

Net Income: $48M

Cash + Equivalents: $1.39B

LT Debt: negligible

Thanks to everyone on the GameStop team for their continued hard work. $GME

Let’s break it down for everyone in the back:

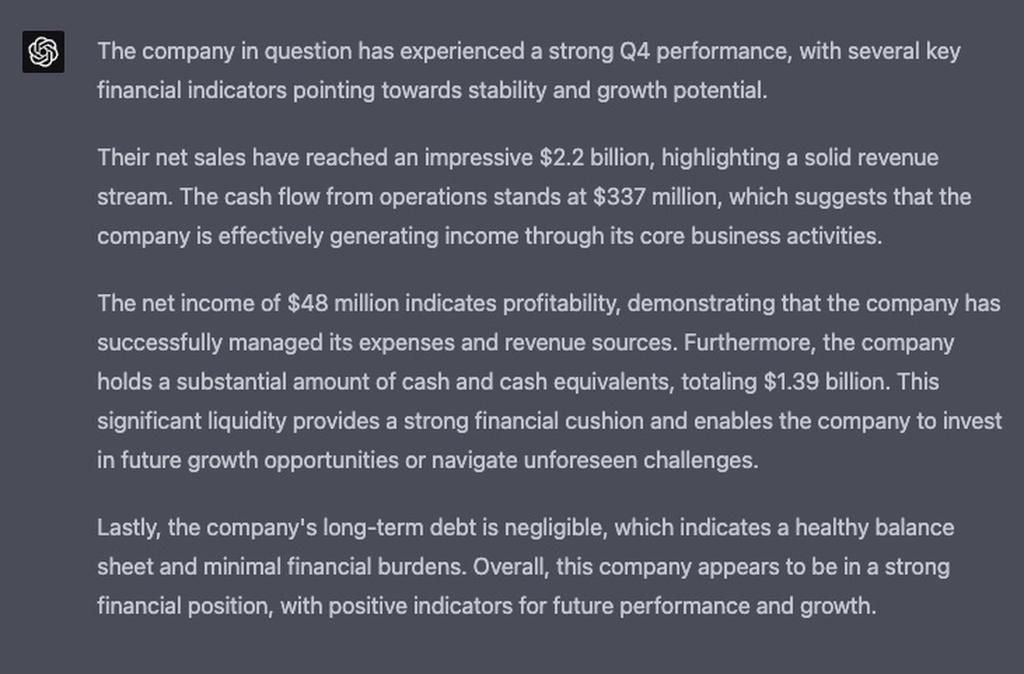

- GameStop’s Q4 net sales reached a whopping $2.2 billion, albeit slightly lower than the previous year.

- GameStop generated a positive free cash flow of $52.3 million in 2022, proving that the company is raking in more cash than it needs to keep the gears turning.

- GameStop’s quarterly net income soared into positive territory for the first time in years, landing at an impressive $48 million.

- Sitting atop a mountain of money, GameStop boasts nearly $1.4 billion in cash and cash equivalents—a sum equal to 20% of the company’s market capitalization.

- With financial flexibility, GameStop has virtually eliminated its debt, save for a small, low-interest, unsecured term loan linked to the French government’s COVID-19 response efforts.

This certainly doesn’t depict the portrait of a business on the brink of collapse.

The Media Spin Machine Goes into Overdrive

With the bear case against GameStop severely undermined by the company’s recent financial success, one would expect media coverage to shift toward a more positive tone. After all, the company has demonstrated its ability to defy expectations and turn the tide in its favor.

A quick scan of recent headlines reveals otherwise. Instead of acknowledging GameStop’s accomplishments and progress, the financial news outlets continue to cast doubt and skepticism on the company’s future.

What Gives?

I can think of several reasons why the pundits are still bashing GME. The first reason comes down to simple human psychology.

Picture yourself as an “analyst” who has been heralding GameStop’s downfall for years—even dishing out questionable financial advice like Anthony Chukumba’s infamous “Sell the stock first, ask questions later” statement (does that advice make sense in any context?).

Now, you’re caught off-guard by a stellar quarter. Will you concede that GameStop could be making a comeback? It’s unlikely, as doing so would require admitting you were wrong, and let’s face it—owning up to our mistakes can be a tough pill to swallow.

Absolute Disrespect For GameStop Shareholders

Another reason the media machine hasn’t relented is that Wall Street still thinks “retail” is stupid.

Wall Street likes to make a clear distinction between Institutional Investors and Retail Investors. It’s Smart Money versus Dumb Money.

Considering GameStop investors—let alone all retail investors—to be “dumb money” is an outmoded, passé stance that will drive your hedge fund into the ground. But these fools are too busy getting high to realize that “retail” is wiser than ever.

Most retail GameStop investors are simply following sound investment advice.

The money is made in investments by investing and by owning good companies for long periods of time. If they buy good companies, buy them over time, they’re going to do fine 10, 20, 30 years from now. If they’re trying to buy and sell stocks, and worry when they go down a little bit … and think they should maybe they should sell them when they go up, they’re not going to have very good results.

Warren Buffet - CNN

Is GameStop A Good Company?

For an unbiased opinion (not to mention the shits and giggles), I asked GPT-4 to analyze the numbers from GameStop’s 10K and give an assessment. The following is not investment advice, but it’s probably just as valuable as any other “analyst” looking at GameStop without an agenda.

Investors are Directly Registering Shares

Retail investors aren’t just buying GME and holding—they are registering their shares in their own name, removing the shares from the Wall Street casino.

Whenever you purchase a share with any broker, whether it’s Robinhood or Vanguard you don’t really own them and can’t 100% control their lending status. […] There is a massive financial incentive for them to lend your shares to short sellers and historically speaking they have done everything in their legal authority to lend them. Registering your shares in your name […] is the only guaranteed way to prevent this from happening.

https://www.reddit.com/r/Superstonk/comments/ptvaka/when_you_wish_upon_a_star_a_complete_guide_to/

The journey of GameStop has been a rollercoaster ride, with the company proving its resilience in the face of continuous negative media coverage and skepticism from Wall Street.

GameStop has defied expectations and emerged stronger, proving that retail investors are far from being the “dumb money” many analysts have dismissed them as.

As we move forward, it’s essential to recognize the power of the retail investor and the importance of reevaluating old biases, especially when the numbers tell a different story. It’s high time we challenge the status quo and celebrate the collective wisdom that retail investors bring to the table.