Short & Distort: The brazen open secret of Wall Street. A dance of deceit designed to annihilate stocks for fun and profit. A scheme so simple, practical, and hard to prove that it’s been used for decades to destroy companies and profit from their demise.

I’ve previously written about the tactics used to short and distort GameStop. But I’ve never explained the scheme in detail. This article will change that.

The Anatomy of Short & Distort

The Short & Distort tactic involves shorting a stock while coordinating a meticulous attempt to drive down its price via misleading information about the targeted company. Here’s how the wicked waltz unfolds:

The schemer, often a hedge fund or a group of traders, takes a short position in a stock. This means they borrow shares to sell them at the current market price with the intention of repurchasing them later at a lower price.

Once the short position is established, the schemer initiates a smear campaign against the targeted company. This involves spreading negative rumors, false news, or exaggerated claims about the company’s financial health, management, legal troubles, or any other aspect that can cause investors to panic and sell their shares. Often, the schemer will time a massive short sale to coincide with the release of negative news to maximize the impact.

As false information spreads and panic ensues, the stock price falls. This is often exacerbated by the fact that the schemer has a significant influence in the market, and their actions are closely followed by other traders.

Once the stock price has dropped significantly, the schemer buys back the shares they initially borrowed. They profit from the difference since they are repurchasing the shares at a lower price.

Sometimes, the schemer will repeat the process several times to maximize profits. This involves taking a new short position after covering the previous one and initiating another round of negative publicity.

The schemer may use a variety of media outlets to spread the false information, including social media, blogs, and even mainstream news outlets. The method of shorting the stock may also vary; they may use options, swaps, and other derivatives or ETFs to short a stock that is otherwise too hard (or too expensive) to borrow.

Welcome to the Puppet Show

While it’s easy to pin the blame solely on the schemers, they are often just one part of a more extensive network involved in a successful Short & Distort operation.

Media Outlets

Some media personalities, knowingly or unknowingly, become accomplices in the scheme by disseminating false or misleading information. It is effortless to say, “Hey, we’re just reporting news from our sources,” which is plausible and difficult to disprove.

This amplifies the impact and helps further drive down the stock price.

Analysts and Financial Experts

Financial analysts may issue negative reports or downgrade the targeted company’s stock, fueling the fire. It is often difficult to discern whether they are doing this knowingly or have been misled by the false information.

Regulatory Bodies Are Less Than Helpful

Regulators are supposed to prevent and punish market manipulation, but they’re often just playing catch up and fail to do a damned thing. Investigating and proving market manipulation is complex and time-consuming, allowing schemers to operate with impunity.

GameStop: Unfolding in Real-Time

It’s happening right now, in 2023.

Let’s set the stage. GameStop, the darling of retail and the bane of Wall Street is attempting a turnaround. The company is reinventing itself under the leadership of Ryan Cohen, the co-founder of Chewy.

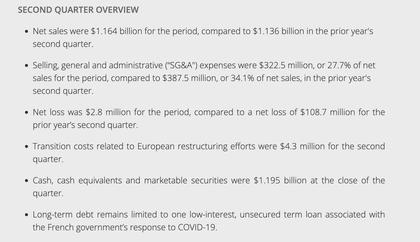

On September 6th, 2023, GameStop reported second-quarter earnings that obliterated estimates. Net income and net profit margin were up year-over-year by about 97%. The few analysts that cover the company were expecting a loss of approximately 14 cents per share, but GameStop nearly broke even, reporting a loss of only ~1 cent per share.

In a struggling retail environment loaded with inflationary pressure, GameStop’s turnaround is nothing short of miraculous. Not to mention that retailers like GameStop usually make all their money during the holiday season, so the company’s performance in the second quarter is a strong indicator that GameStop is back, baby, and better than ever.

The short-sellers are in trouble. A positive earnings report like this spells disaster for those deeply invested in the company’s demise. So, what’s a hedge fund to do when faced with potential ruin? Engage the Short & Distort protocol, of course.

Step 1: Create a Crisis

The first move in the Short & Distort playbook is to fabricate a crisis. What better way to do that than to leverage the authority of regulatory bodies?

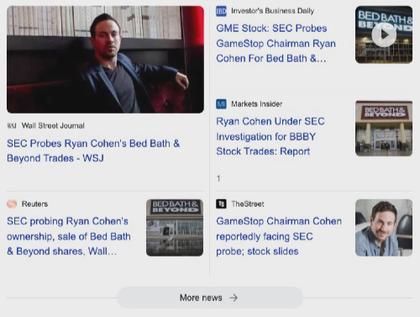

The U.S. Securities and Exchange Commission (SEC) is investigating billionaire Ryan Cohen’s ownership and surprise sale of Bed Bath & Beyond shares

U.S.News citing Reuters

Ah, they are citing Reuters. That gives the story some credibility. But wait, what’s this?

The U.S. Securities and Exchange Commission (SEC) is investigating billionaire Ryan Cohen’s ownership and surprise sale of Bed Bath & Beyond shares, the Wall Street Journal reported on Thursday.

Reuters citing the Wall Street Journal

Reuters is citing the Wall Street Journal. Okay, now we’re getting somewhere. But wait, what’s this?

The SEC has requested information from Cohen about his trades and his communications with officers or directors at Bed Bath & Beyond, according to people familiar with the matter.

The Wall Street Journal citing “people familiar with the matter”

Ah, that old chestnut: the ubiquitous “people familiar with the matter.” The Wall Street Journal is citing anonymous sources. This is a common tactic used by media outlets to lend credibility to a story without having to provide any evidence. It’s a way to say, “Hey, we’re just reporting the news, not making claims,” while simultaneously spreading bullshit. Meanwhile, the online media machine propagates the story like wildfire.

There needs to be more accountability and transparency in this reporting. In fact, this is all ancient news from 2022, when Cohen sold his Bed Bath & Beyond shares. But I guess it’s essential to report on it now, after GameStop’s incendiary earnings report, because… reasons?

Don’t Forget About Twxtter

Know who doesn’t like to invest in fraudulent companies with fraudulent owners? Institutional investors… that’s who! Now think of all those DRS shares locked that can no longer get out quick when bad news hits the fan… haha $gme @gamestop rush to the exits will now begin! Made… pic.twitter.com/p0BY26jTrD

— Adam (@Adam_Tang) September 8, 2023

Step 2: The Art of Stealth Shorting

Once the seed of panic is sown, it’s time to manipulate the price. But how do you short a stock that is notoriously difficult to borrow? You use an ETF already obliterated by unbridled short interest, of course. ETFs can print new shares out of thin air, so you can short them to your heart’s content.

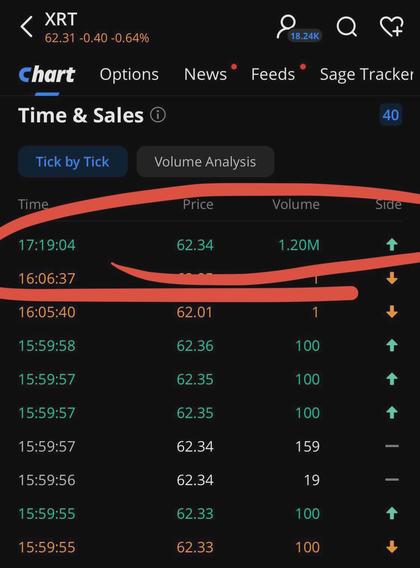

At 5:19pm, XRT (SPDR® S&P® Retail ETF) volume exploded with 1.2 million shares.

A classic but little-known tactic for shorting a stock is funneling your activity through an ETF containing the stock you want to short. XRT shares outstanding are around 4 million, and their short interest is over 17 million (yes, that means the ETF is shorted more than 4x its shares outstanding).

Step 3: After Hours Shenanigans

The market closes at 4 p.m., but the after-hours market is still open. This is where the real fun begins. GME was blasted 5% down on a meager handful of shares traded. The after-hours market is a playground for market manipulators. It’s a place where you can move the price with far less effort than during regular trading hours while the resulting chart looks far more dramatic than it actually is.

Step 4: Apply Pressure to the Wound

With the stock price skillfully manipulated in the after-hours, it’s crucial to tie the decline back to the manufactured crisis that set this all in motion. The conclusion that begs the question has already been written:

GameStop slides on report billionaire investor Ryan Cohen face [sic] SEC probe.

They were so eager to publish this story that they didn’t even bother to proofread the headline (they’ve since changed the title a few times).

A Game We Refuse to Lose

The stock market is not a level playing field. It is a rigged game where the wealthy and powerful manipulate the system to their advantage, often at the average investor’s expense. This is not just a theory but a reality that plays out repeatedly, with GameStop being just one of many examples.

We need to question the narratives we’re fed while being careful to not fall into the trap of conspiracy theories. We must scrutinize our information sources and demand accountability from those in power.

One practical step that every shareholder can take is directly registering their shares with a transfer agent. This process, known as Direct Registration of Shares (DRS), removes your shares from the brokerage system and, in essence, takes them off the market. By doing this, you are extracting your shares from a system that has shown itself to be corrupt and putting the power back in your hands as an individual investor.

This is not just about one stock or company; this is about the integrity of the financial system. It’s about standing up to the forces manipulating the markets and saying, “Enough is enough.”

It’s about demanding transparency, accountability, and fair play.

It is a David and Goliath battle but remember: David won.

The market manipulators may have the resources, the connections, and the experience, but we have something they don’t: the truth. And in the end, the truth always prevails.

So, the next time you see a headline screaming about a stock plummeting due to “negative news,” take a moment to question the narrative. Look for the puppeteers pulling the strings behind the scenes. Because in a world where deceit and manipulation are the orders of the day, the only defense is a well-informed mind.

Let’s get informed, let’s get empowered, and let’s change the game.