Late last year, The Chainsaw published an article alleging that hedge funds used FTX’s tokenized stocks to manipulate GameStop’s stock.

Now that FTX is in the toilet, it has become difficult to track the 10 million GME shares that supposedly backed the tokens, raising the question of whether FTX ever owned the shares in the first place.

To understand what’s going on, let’s take a deep dive into FTX’s tokenized stocks, the claims made by The Chainsaw, and what Sam Bankman-Fried has to say about it (for whatever that’s worth).

What The Hell Is A Tokenized Stock?

Tokenized stocks are fancy derivatives representing ownership of traditional stocks. Investors trade these tokens on blockchain exchanges. They provide several advantages over traditional stocks:

- Unlike with traditional stock exchanges, one can trade tokenized stocks 24/7.

- Tokenized stocks often represent fractional shares which are cheaper and easier to trade for smaller accounts.

- There is no “Pattern Day Trader” designation for day trading tokenized stocks.

Explain Tokenized Stocks Like I’m Five

Imagine there is a giant chocolate bar that represents a company. Each square of the chocolate bar is like a piece of the company, called a stock.

Traditionally, you would go to the Chocolate Exchange to buy and sell whole squares of chocolate. The Chocolate Exchange is highly regulated, only open for six and a half hours, and the individual squares of chocolate are expensive.

Sammy sees an opportunity to do a capitalism. He buys 100 squares of chocolate, breaks them into small chocolate chips, and sticks them in his fridge.

He opens a new exchange called “Forreal Trustme eXchange” that tracks who owns which chips using a transparent notebook. Users don’t buy or sell physical chocolate chips; instead, they trade paper slips representing the chocolate chips.

At any time, a user may redeem their slips of paper with Sammy for real chocolate chips. However, nobody generally does that; they are more interested in day-trading slips of paper, and they are excited to trade all day with fewer regulatory barriers.

What Are The Chainsaw Allegations?

On November 16th, 2022, Tom Mitchelhill published an article stating that brokers could use FTX tokenized shares to manipulate the cost to borrow (CTB) for GME, that the tokens were not redeemable for the underlying, and that FTX probably never owned any GME shares in the first place.

Were The Shares Actually Redeemable?

It is well known that FTX was lying to their customers about all the fuckery between FTX and Alameda Research, so it should come as no surprise that they were also lying about the ability to redeem tokenized shares for bonafide GME Class A Common Stock.

These spot tokens are backed by shares […] custodied by FTX Switzerland. They can be redeemed with FTX Switzerland for the underlying shares if desired.

FTX on ftx.com, now deleted.

The Chainsaw dug into FTX’s terms of service for tokenized stocks, and despite the above assurances, they discovered that buyers of tokenized stocks on FTX did not have a claim to delivery of the underlying. This flew directly in the face of their public statements about redeemability.

Manipulating Cost To Borrow

When you borrow shares from a broker to sell short, the broker has to claim they can locate the shares. The harder it is to find shares to borrow, the more expensive it is to borrow those shares.

To paraphrase analyst Peter Hann, if some stupid crypto exchange says that they have millions of tokens that are exchangeable for shares, then maybe the broker can claim they can locate the shares, causing the cost to borrow to go down.

When the cost to borrow a share remains low, hedge funds don’t have to pay as much to maintain their short positions.

The ethics of shorting aside, this allegation doesn’t sound like such a big deal. If these shares were locatable, the system seemed to work as designed. However, disregarding that the tokenized stocks terms contradicted FTX’s claims of redeemability, what if FTX never actually owned any GME shares?

FTX Probably Didn’t Own The Underlying Shares

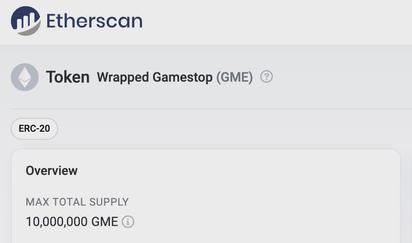

This one is a doozy, and the research is credible. The Ethereum smart contract for tokenized GME stock on FTX shows a balance of 10 million Wrapped GameStop tokens in circulation.

FTX’s website claimed that their tokenized stocks were backed one-to-one with actual shares, custodied by FTX Switzerland. If true, the 10 million shares should be displayed as institutional holdings in SEC documents.

There is however no such listing of FTX Switzerland as being an institutional holder of the 10,000,000 GME tokens on the official NASDAQ website, where companies are required by law to list their holdings. This means that 10 million GameStop ‘shares’ were printed out of thin air.

The Chainsaw

There are currently only two institutional holders with 10 million or more shares: Vanguard Group and Blackrock.

What About CM Equity AG?

Another entity that provided custodial services to FTX was CM Equity AG. However, CM Equity AG discontinued their relationship with FTX on December 31, 2021.

Unusual Whales Interview

In an interview with Unusual Whales, Sam Bankman-Fried had the following response when asked wheter GME shares were backed one-to-one with tokenized shares:

Uh, to my knowledge, they were, but I want to get you a better answer to that question and whether—I don’t have an updated answer to that question after the shitshow, and I think that’s a very reasonable question to ask.

Sam Bankman-Fried

Putting It All Together

Hedge funds have so heavily shorted GME that the cost to borrow shares should be extremely high compared to other securities.

However, brokers could reasonably claim to locate up to 10 million GME shares, supposedly custodied by FTX Switzerland and redeemable via tokenized shares, even though FTX’s terms conflicted with their publicly stated claims of redeemability.

Furthermore, it is verifiably improbable that either FTX Switzerland or CM Equity AG ever owned GME shares. Ten million shares of GME would make FTX Switzerland the third largest institutional holder of GME, yet there is no record of their holdings with the SEC.

So where are those 10 million shares? They probably don’t exist.