If you haven’t been following along, the global banking system has learned nothing since the 2008 financial crisis. After the longest bull market in history, inflation is breaking records, and interest rates are popping. However, banks seem to be failing left and right—again. What gives?

Two Years Ago: Credit Suisse & Archegos Capital Management

It’s impossible to know when these failing banks first bit off more than they could chew, but the Credit Suisse & Archegos Capital Management debacle was the first massive indicator that greed was back on the menu.

Credit Suisse is (was?) one of the world’s most important financial institutions, but in 2021 they were running their Prime Services business like a degenerate gambler betting everything on roulette.

They weren’t the only bank caught in Archegos’ spectacular implosion—Japan’s Nomura Holdings lost their fair share of billions—but as Archegos went down, Goldman Sachs, Morgan Stanley, and Deutsche Bank scrambled to close their positions quickly, leaving Credit Suisse holding the bag with a massive $5.5 billion loss.

The Archegos-related losses sustained by CS are the result of a fundamental failure of management and controls […]. The business was focused on maximizing short-term profits and failed to rein in and, indeed, enabled Archegos’s voracious risk-taking.

Credit Suisse Group Special Committee of the Board of Directors report on Archegos Capital Management (PDF)

Not only were they enabling Archegos Capital Management to build a massive amount of risk, they knew it was dangerous:

There were numerous warning signals—including large, persistent limit breaches—indicating that Archegos’s concentrated, volatile, and severely under-margined swap positions posed potentially catastrophic risk to CS. Yet the business, from the in-business risk managers to the Global Head of Equities, as well as the risk function, failed to heed these signs

Credit Suisse Group Special Committee of the Board of Directors report on Archegos Capital Management (PDF)

This was the beginning of the end for Credit Suisse, but we’ll return to them.

Inflation & Interest & QT, Oh My!

In 2022, inflation in the U.S. reached its highest rate since 1982.

It’s the Fed’s job to manage inflation. When inflation is running red hot, the Fed tightens monetary policy by raising interest rates. Let’s connect the dots on how raising interest rates affects inflation.

- It becomes more expensive for people and businesses to borrow money, which can decrease spending.

- People may be more likely to save their money rather than spend it, which can decrease demand for goods and services.

- It can make the U.S. Dollar more attractive to foreign capital, increasing its value. A strong currency makes imports cheaper, reducing inflationary pressures by lowering the cost of goods.

What’s The Downside?

It’s all about bonds, baby.

- If you own a bond and interest rates rise, the value of your bond will likely decrease because investors can earn more on newly issued bonds. In other words, they are less willing to pay full price for your existing bond with a lower interest rate.

- Investors may be more willing to sell their existing bonds and buy newly issued bonds. This reduces demand and lowers prices.

- Bonds are generally considered lower-risk investments, but if the value of those bonds were used for collateral, marge comes calling.

Quantitative Tightening

You may have heard of Quantitative Easing (QE). It’s a complicated term for a relatively simple operation. Quantitative Easing means the Fed is buying assets—such as mortgage-backed securities and government bonds—to pump money into circulation.

Due to the COVID-19 pandemic, the Fed put its QE program into overdrive, raising its balance sheet of assets to over $8 trillion(!?). This is what online communities fondly refer to as “the money printer.”

QE is one of the factors that led to massive inflation, so in 2022, the Fed reversed the process and started Quantitative Tightening (QT)—selling assets on their balance sheet. This added to the selling pressure on bonds, devaluing them further.

Silvergate Bank: The Harbinger

You’ve likely never heard of Silvergate Bank, as they were focused on servicing the banking needs of the crypto industry.

Unlike their risky customers’ endeavors, Silvergate’s investments were generally conservative. However, very much like the banks caught in the 2008 financial crisis, Silvergate held large positions in mortgage-backed securities and U.S. Bonds.

Usually, this isn’t a big deal, as bonds are considered long-term investments, and the bank only books losses once the bonds are sold.

FTX Goes Boom

Unless you’re living under a rock, you know that the crypto industry was besieged in 2022 by the stunning collapse of FTX, one of the largest cryptocurrency exchanges in the world.

A classic bank run on Silvergate occurred as FTX crumbled, with deposits from cryptocurrency-related companies dropping by 68%. What does a bank do if it doesn’t have enough cash on hand to service withdrawals? It sells assets—even if those sales are for a loss.

Silvergate realized a loss of $718 million in withdrawal-related asset sales. They struggled through the first quarter of 2023 until finally releasing a public notice on March 8th that they would undergo voluntary liquidation.

Silicon Valley Bank Takes A Plunge

March 8th would be a dark day for more than just Silvergate.

From 2019 to 2022, SVB experienced massive growth, tripling in size with significant deposits. What did they do with all that cash?

They bought treasuries and other bonds—billions of dollars worth.

Unfortunately for SVB, their customers were primarily technology startups. 2022 was a horrible year for most investments, but technology had it particularly rough. Those firms needed a lot of cash, and they pulled it out of their SVB accounts.

As the value of SVB’s bond investments fell, and their beleaguered customers withdrew funds to cover their own financial troubles, SVB’s available cash was pinched. They were forced to sell some of their bonds to cover the withdrawals, booking a loss of ~$1.8 billion.

Unlike Silvergate, SVB’s collapse was lightning fast:

- On Wednesday, March 8th—as Silvergate announced liquidation—SVB announced their $1.8 billion loss and plans to raise $2.25 billion via stock offerings.

- On Thursday, SVB’s parent company’s stock crashed, and the bank run was in high gear: customers attempted to withdraw $42 billion (PDF) in total.

- Trading halted on Friday, and federal regulators announced they would take over the bank.

A few days later, on Sunday, federal regulators announced drastic measures that would unknowingly exacerbate the wounded banking system. Although investors in SVB were screwed, all SVB customers would be made whole, including uninsured deposits; this incredible generosity would come back to haunt them in the coming weeks.

Signature Bank: Silvergate 2 Electric Boogaloo

Deposits in Signature Bank declined in 2022 from $106 billion to $88.6 billion. After courting cryptocurrency businesses for years, they cut ties with Binance in 2022 to reduce exposure to the crypto industry.

However, with Silicon Valley Bank collapsing in real-time and the specter of Silvergate Bank in liquidation, Signature Bank was hit with a multi-billion dollar bank run on Friday, March 10th.

By March 12th, days after the collapse of SVB, regulators closed Signature Bank.

First Republic, Last Of Its Name

Like Silicon Valley Bank, Signature Bank, and Silvergate Bank, depositors in the California-based First Republic started yanking out their money in March—they feared that First Republic would fall victim to contagion.

The lender recently announced that it had lined up $70 billion in new financing, causing depositors to worry that First Republic was experiencing a liquidity crisis.

However, unlike its failing predecessors, 11 of First National’s rivals stepped in to provide liquidity.

Bank of America, Citigroup, J.P. Morgan Chase, and Wells Fargo will deposit $5 billion each. Goldman Sachs and Morgan Stanley will deposit $2.5 billion each. An additional $5 billion will come from five other banks.

David Gura, NPR

Holy shit, that’s a lot of money for a rival bank! It seems that “big money” is circling their wagons. First National is a smaller bank—certainly not one of the big players. Why would everyone suddenly swoop in to save such a small bank with billions of dollars?

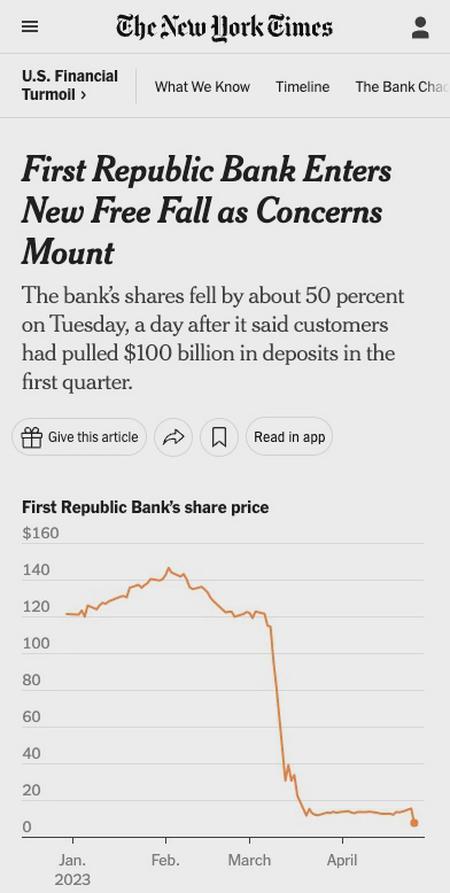

UPDATE: Wednesday, April 26, 2023

The storm hovering over First Republic Bank has finally broken.

Merely a month after publishing this review, First Republic Bank is still in the eye of a financial hurricane. Its customers, rattled by the revelations, have withdrawn a staggering $100 billion in the first quarter, amounting to approximately 40% of their total holdings.

The markets reacted with swift ferocity. First Republic Bank’s stock, trading under the symbol $FRC, nosedived a breathtaking 50% the very next day. Trading was halted multiple times as panic set in and investors scrambled to cut their losses.

But the financial bloodbath didn’t end there. The following morning, as the sun rose on a new day of uncertainty, $FRC continued its freefall, shedding an additional 40% of its value.

As I pen this update, the fate of First Republic Bank hangs in the balance. With each passing moment, it seems increasingly likely that it will soon join the graveyard of failed banks that have been laid to rest on this list.

…now back to the original article.

Debit Suisse Takes An Arrow To The Knee

Debit (Credit) Suisse never stopped reeling after the Archegos debacle. It doesn’t help that that the 167-year-old institution has continued to log scandal after scandal, from cocaine trafficking to tuna boat fraud in Mozambique.

This week, Debit Suisse sought help from the Swiss government after revealing it had found “material weakness” in its financial situation, and Saudi National Bank (it’s top shareholder) said it could not give them any more money.

This is Credit Suisse’s Lehman Brothers moment.

United Bank of Switzerland & Swiss National Bank

Credit Suisse is fucked—and the Swiss National Bank is well aware. The global banking system is yet again in peril.

In an unprecedented move, the Swiss National Bank has decided that United Bank of Switzerland (UBS)—a competitor to Credit Suisse—should buy Credit Suisse to prevent the bank from failing. United Bank of Switzerland has agreed to buy Credit Suisse for $2 billion (a fraction of CS share price). The Swiss National Bank has agreed to offer $100 billion in liquidity as part of the deal.

The Swiss Government is prepping emergency measures to fast-track the takeover; they plan to bypass the six-week consultation period for UBS shareholders so the deal can be sealed immediately.

Fuckin what?

You heard that right. Swiss regulators will change laws so that UBS can buy CS tonight without UBS shareholder input. What do you think United Bank of Switzerland shareholders are going to do tomorrow, March 20th, Monday morning?

If I were a shareholder, I would sell.

Contagion.

Midsize U.S. Banks Are Panicking

The Mid-Size Bank Coalition of America has sent a letter to regulators, begging them to extend FDIC insurance to all deposits for the next two years.

The reason? People are scared.

Look at it this way:

If the government has decided that certain banks cannot fail, wouldn’t you want your money held by those banks? With the collapse of SVB and the subsequent guarantee by federal regulators that all depositors will be made whole, it would seem that regulators are picking and choosing which banks get “special” insurance above and beyond the $250k FDIC limit.

Given the current climate, if I had more than $250k in a mid-sized bank, my shareholders would demand that I withdraw my funds and move them to a bank considered too big to fail.

Would this cause my mid-sized bank to fail due to a bank run?

Make no mistake: we are smack dab in the middle of a banking crisis.